Any business needs funds to grow or expand its company. There are numerous sources from which one can obtain access to capital. But this could be a little challenging as one needs to consider several factors.

Let us learn more about the potential causes of business loan rejections and how to overcome them.

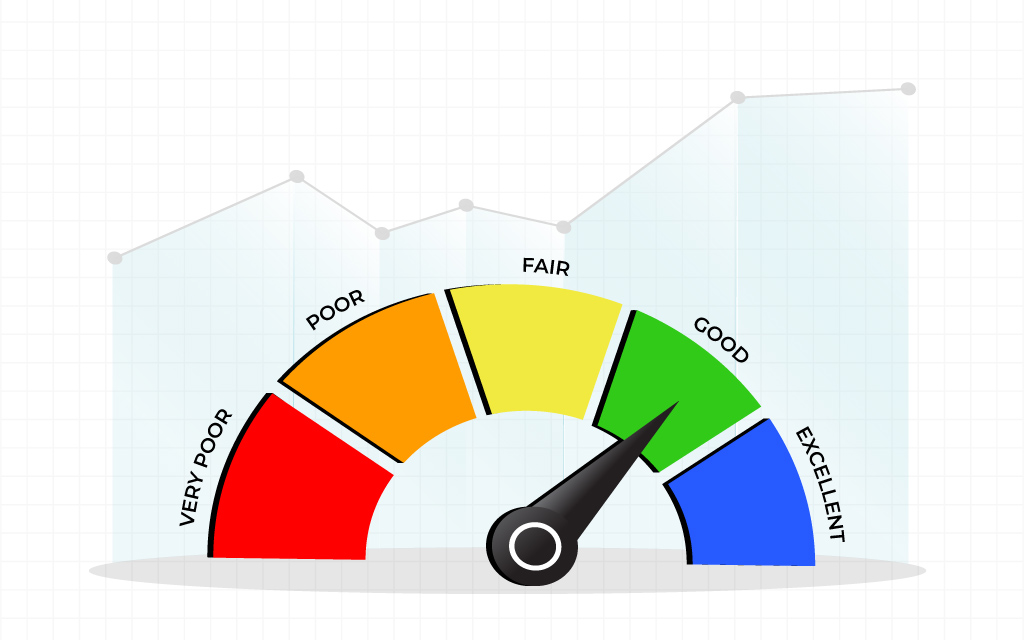

1. Credit score

If you have taken a lot of credit and loans, your credit history will show a low credit score.

If your credit score is low, this could lead to financial institutions rejecting your loan application.

However, if the business is new, there will be no history highlighting poor credit scores.

Tap the link if you wish to know how you can improve your credit score: https://trucapfinance.com/how-to-improve-your-credit-score/

2. Business potential to repay the loan

Financial institutions need the past performance history of the businesses. A company’s cash inflows from current activities and outside investment sources are cross-checked. The financial statement shows your capability to repay the loan after removing the operating expenses.

3. Applied or enquired about the loan from multiple sources

When applying for a loan, the financial institution takes note of all your past performances, including your previous loan application and debt history.

The higher the debt, the lower the chances of getting a loan. Your limited ability to pay back the loan’s principal and interest may raise suspicions in the lender’s mind.

The lender will reject your application because they consider it to be risky.

4. Unclear purpose of the loan

Before requesting a loan, the firm must answer questions such as “why” it needs one, “will the loan be used for the growth and advancement of the company,” and “whether there is a clear strategy and plan connected to business expansion.”

There is a greater possibility of rejection if the lender cannot clearly understand your development plans.

5. Documentation

If the documents are not false or fill incorrect information in the application form, the lender may instantly reject the requested loan amount. Filling out the forms involves careful attention.

Advice on how to handle it-

- Fill the form with proper and correct details, strongly suggested to keep all the documents in hand and then start filling. Do not panic or get impatient while filling out the form.

- Add collaterals for repaying the loan. If you cannot pay the loan, collaterals can help you for easy repayment. Gold can function as the best collateral you can use in times of emergency. Know more about gold loans, check the link:

- Establish definite objectives and plans for the growth of the company for which you are seeking funding.

- You can boost your income by reducing unnecessary spending and working on improving your personal and professional credit scores. To do this, pay all your bills on time, pay back all past loans, and maintain strong financial standing.

Conclusion

Avoid applying for a loan right after having one rejected because doing so could damage your credit score.

Ideally, you should wait between 30 and 45 days before applying